-

Gallery of Images:

-

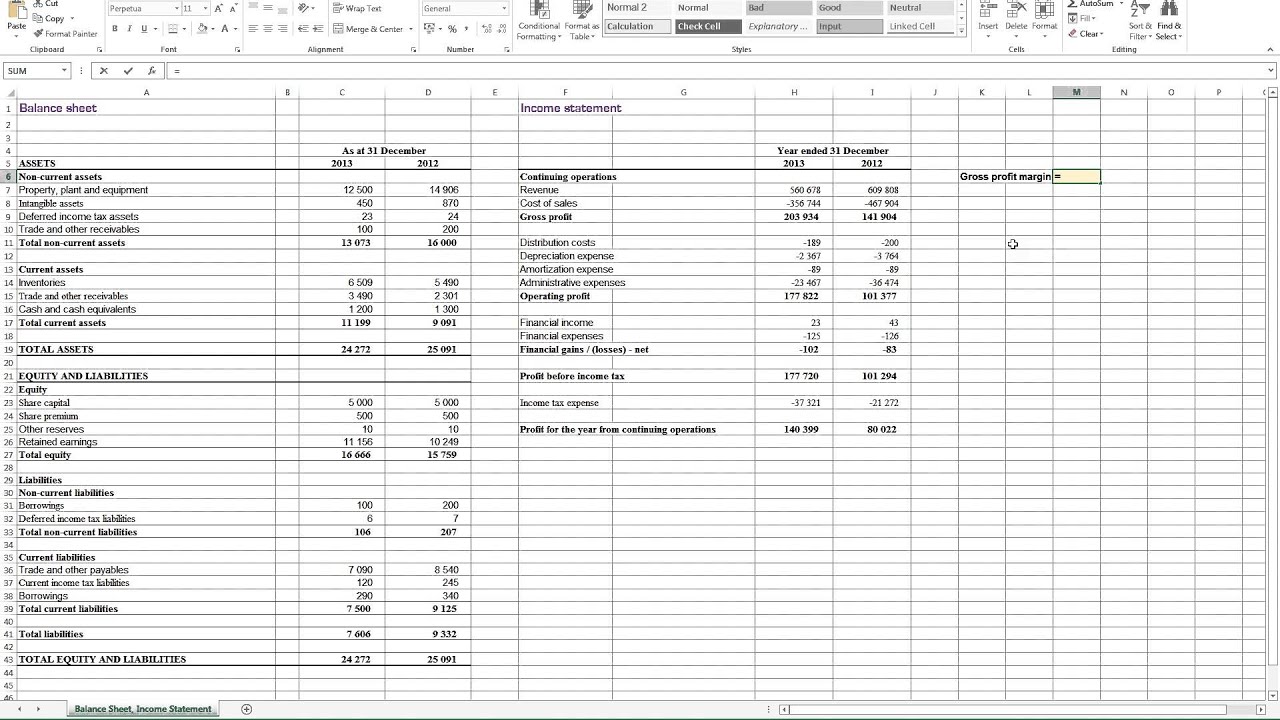

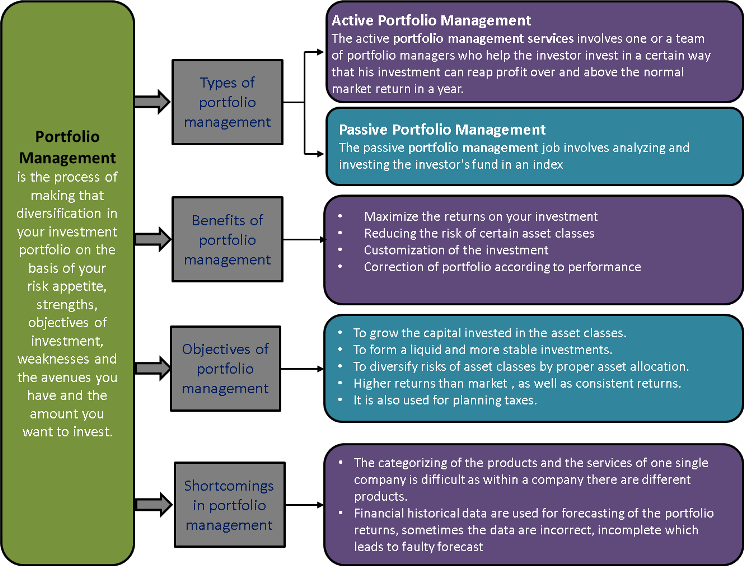

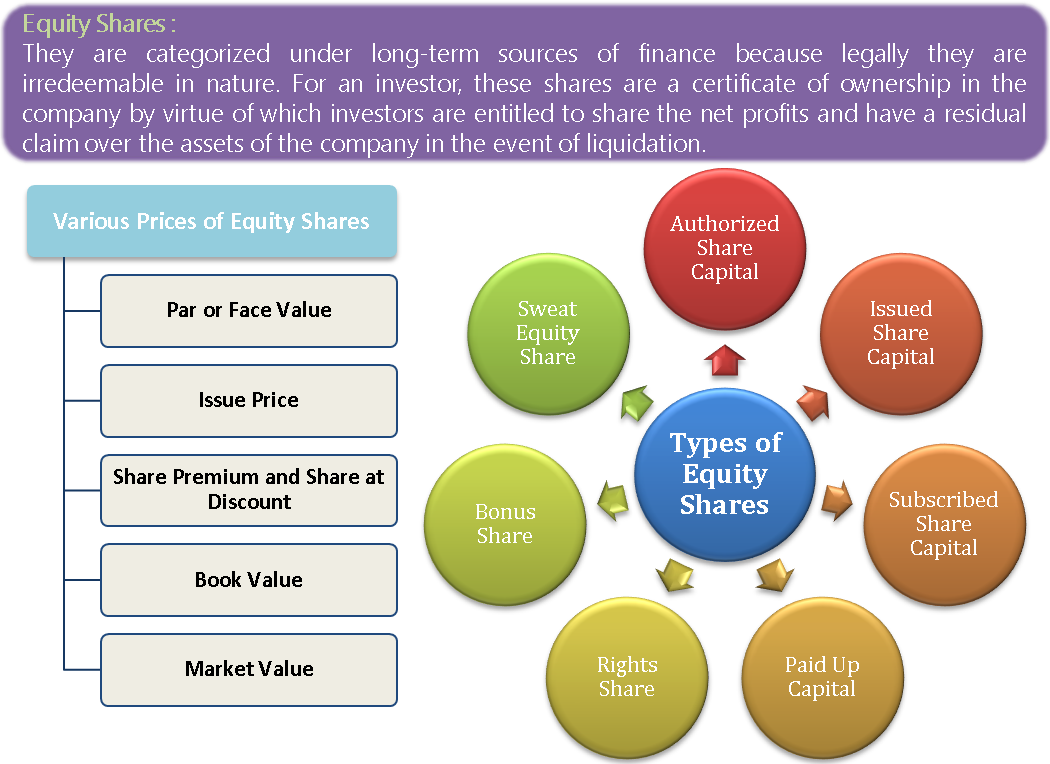

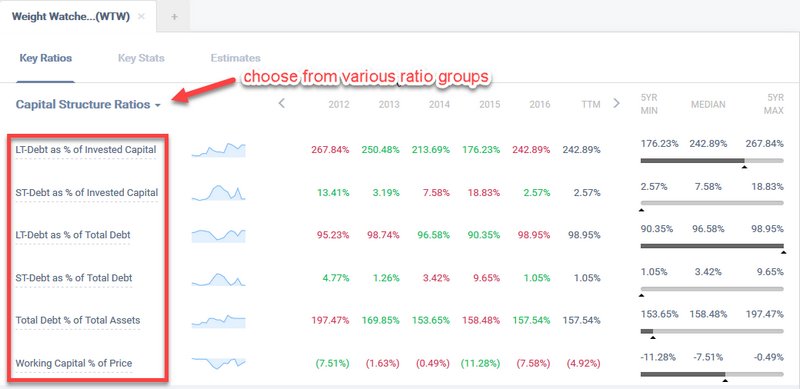

Liquidity Ratios Home Financial Ratio Analysis Liquidity Ratios Liquidity ratios analyze the ability of a company to pay off both its current liabilities as they become due as well as their longterm liabilities as they become current. Computing and interpreting financial ratios is the cornerstone of financial statement analysis. The main financial statements are the balance sheet, income statement and statement of cash flows. Ratios are fractions that show the relationship between the numerator and denominator. What is financial ratios analysis? The Balance Sheet and the Statement of Income are essential, but they are only the starting point for successful financial management. Apply Ratio Analysis to Financial Statements to analyze the success, failure, and progress of your business. Ratios serve as a comparative tool of analysis for liquidity, profitability, debt, and asset management, among other categoriesall useful areas of financial statement analysis. Companies typically start with industry ratios and data from their own historical financial. Financial statement analysis includes financial ratios. Here are three financial ratios that are based solely on current asset and current liability amounts appearing on a company's balance sheet: Four financial ratios relate balance sheet amounts for Accounts Receivable and Inventory to income statement amounts. When you take an owner earnings approach to income statement analysis, you need all three financial statements together balance sheet, income statement, and cash flow statements as well as the ability to discount cash flows to come up with a net present value. RMA's Annual Statement Studies is the only source of comparative industry benchmark data that comes directly from the financial statements of small and mediumsize business clients of RMAs member institutions. Introduction to Financial Statement Analysis 1 Explain the purpose of financial statement analysis. 2 Understand the relationships between financial statement numbers The informativeness of financial ratios is greatly enhanced when they are compared with. Ratio analysis is used to evaluate relationships among financial statement items. The ratios are used to identify trends over time for one company or to compare two or more companies at one point in time. Financial statement ratio analysis focuses on three key aspects of a. Ratios and Formulas in Customer Financial Analysis. Financial statement analysis is a judgmental process. One of the primary objectives is identification of major changes in trends, and relationships and the investigation of the reasons underlying those changes. To analyze a financial statement, investors use three methods: vertical analysis, horizontal analysis and ratio analysis. In vertical analysis, external financiers compare other financial statement items with one item, which is referred to as the benchmark. When it comes to investing, analyzing financial statement information (also known as quantitative analysis), is one of, if not the most important element in the fundamental analysis process. from the File Quick Analysis dialog in Financial Analysis CS. They include twoyear and fiveyear They include twoyear and fiveyear comparisons, industry and group comparisons, and detailed ratio analysis reports for all standard ratios or Ratio Analysis: Using Financial Ratios Now that youve got your hands on the financial statements youll be working with, it is important to know exactly what to do with this data and how to. Financial statement analysis: Critical financial ratios Financial statement analysis: Understanding critical financial ratios and beyond This webinar will provide you with an overview of the three main areas of reviewing financial statements. Financial ratio analysis is performed by comparing two items in the financial statements. The resulting ratio can be interpreted in a way that is not possible when interpreting the items separately. Financial ratios can be classified into ratios that measure: profitability, liquidity, management efficiency, leverage, and valuation growth. Financial Statement Ratio Analysis Financial statements as prepared by the accountant are documents containing in books on financial statement analysis are: 1. Common size statements In this chapter, we are primarily concerned with ratio analysis. The ratios that Financial statement analysis is one of the most important steps in gaining an understanding of the historical, current and potential profitability of a company. Financial analysis is also critical in evaluating Financial Statement AnalysisRatios Board of Directors Shareholders Creditors Governmental Agencies, Employees, Competitors, etc. An item on a financial statement has little meaning by itself. The meaning of the numbers can be Financial Ratios. Ratio analysis involves the construction of ratios using specific elements from the financial statements in ways that help identify the strengths and weaknesses of the firm. Ratios help measure the relative performance of different financial measures that characterize Introduction to Financial Ratios and Financial Statement Analysis 2 Similarly, comparisons of firms only on the basis of ratios can lead to erroneous conclusions. Financial Ratio Analysis A sustainable business and mission requires effective planning and financial management. Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time, and provide key indicators of USING FINANCIAL RATIOS TO MEASURE PERFORMANCE Created Date. Financial analysis Ratios are an effective way of analysing the financial statements. A ratio is 2 figures compared to Capital employed can be found from the statement of financial position by taking the shareholders funds (share capital and reserves) and long term debt. Financial statement analysis compares ratios and trends calculated from data found on financial statements. Financial ratios allow you to compare your business' performance to industry averages or. In this reading, we introduce you to financial ratios the tool of financial analysis. In financial ratio analysis we select the relevant information primarily the financial statement data and evaluate it. We show how to incorporate market data and economic data in the analysis and Financial statement analysis is pretty much just what it says the study of a companys financial statements to determine the past and future performance of the company. The Financial Statements Three nancial statements are critical to nancial statement analysis: the balance sheet, the income statement, and the statement of cash ows. A regular review of your company's financial ratios can help you focus on areas that may need improvement. Liquidity, efficiency, and profitability ratios, compared with other businesses in your industry, can highlight any strengths and weaknesses you might have over your competition. Ratios 2 Common Size Financial Statements Differences in firm size may confound cross sectional and time series analyses. To overcome this problem, common size statements are used. ReadyRatios online software produces a complete financial analysis of your statements: more than 40 ratios and indicators, unique conditional comments, tables, diagrams and summary. Financial statement analysis can be referred as a process of understanding the risk and profitability of a company by analyzing reported financial info, especially annual and quarterly reports. Putting another way, financial statement analysis is a study about accounting ratios among various items included in. Understand the components of bank financial statements and key ratios used in bank analysis Recognise the impact of differing accounting standards and policies (e. provisioning, asset valuation, securitization etc. ) on the financial statements Financial Ratios and Financial Ratio Analysis Explained Would you like to SUPER easily learn more about many financial ratios with even deeper. When computing financial ratios and when doing other financial statement analysis always keep in mind that the financial statements reflect the accounting principles. This means assets are generally not reported at their current value. Financial statement analysis is an exceptionally powerful tool for a variety of users of financial statements, each having different objectives in learning about the financial circumstances of the entity. Commonsize financial statement analysis involves analyzing the balance sheet and income statement using percentages. All income statement line items are stated as a percentage of sales. All income statement line items are stated as a percentage of sales. Financial ratios are mathematical comparisons of financial statement accounts or categories. These relationships between the financial statement accounts help investors, creditors, and internal company management understand how well a business is performing and of areas needing improvement. 3 introduction The Top 15 Financial Ratios F or ordinary investors, the task of determining the health of a listed company by looking at financial Ratio Analysis of Financial Statements This is the most comprehensive guide to Ratio Analysis Financial Statement Analysis This expertwritten guide goes beyond the usual gibberish and explore practical Financial Statement Analysis as used by Investment Bankers and Equity Research Analysts. A Comparative Analysis of the Financial Ratios of Listed Firms Belonging to the financial statement analysis should be made available to all industries for reasons of comparability and activity ratios, education, financial statement analysis, leverage ratios, liquidity ratios, market value ratios, profitability ratios. Introduction Financial statement analysis (or financial analysis) is the process of reviewing and analyzing a company's financial statements to make better economic decisions. These statements include the income statement, balance sheet, statement of cash flows, and a statement of changes in equity. Financial ratios quantify many aspects of a business and are an integral part of the financial statement analysis. Financial ratios are categorized according to the financial aspect of. The four major ratio measurements that users of the financial statements perform to gauge the effectiveness and efficiency of a companys. Financial Statement Analysis is a method of reviewing and analyzing a companys accounting reports (financial statements) in order to gauge its past, present or projected future performance. This process of reviewing the financial statements allows for better economic decision making. How to perform Analysis of Financial Statements. This guide will teach you to perform financial statement analysis of the income statement, balance sheet, and cash flow statement including margins, ratios, growth, liquiditiy, leverage, rates of return and profitability. carrying out any financial analysis, a clear statement of the needs and objectives of A large number of financial ratios can be created to add meaning to the financial and accounting data of a business. However, while the use of financial ratios can be Chapter 7: Financial Analysis and Interpretation 113 This video helps you to learn Calculation of Financial Ratios with the help of practical example. Guide to Financial Ratios Analysis Financial statement analysis. looks first at the balance sheet. The Balance Sheet provides a picture of the financial health of a business at a given moment, usually at the close of an accounting period. It lists in detail those material and intangible items the The use of financial ratios is a timetested method of analyzing a business. Wall Street investment firms, bank loan officers and knowledgeable business owners all use financial ratio analysis to Financial Ratios for Financial Statement Analysis. Book Value of Equity Per Common Share Book Value of Equity for Common Stock Number of Common Shares.

-

Related Images: