-

Gallery of Images:

-

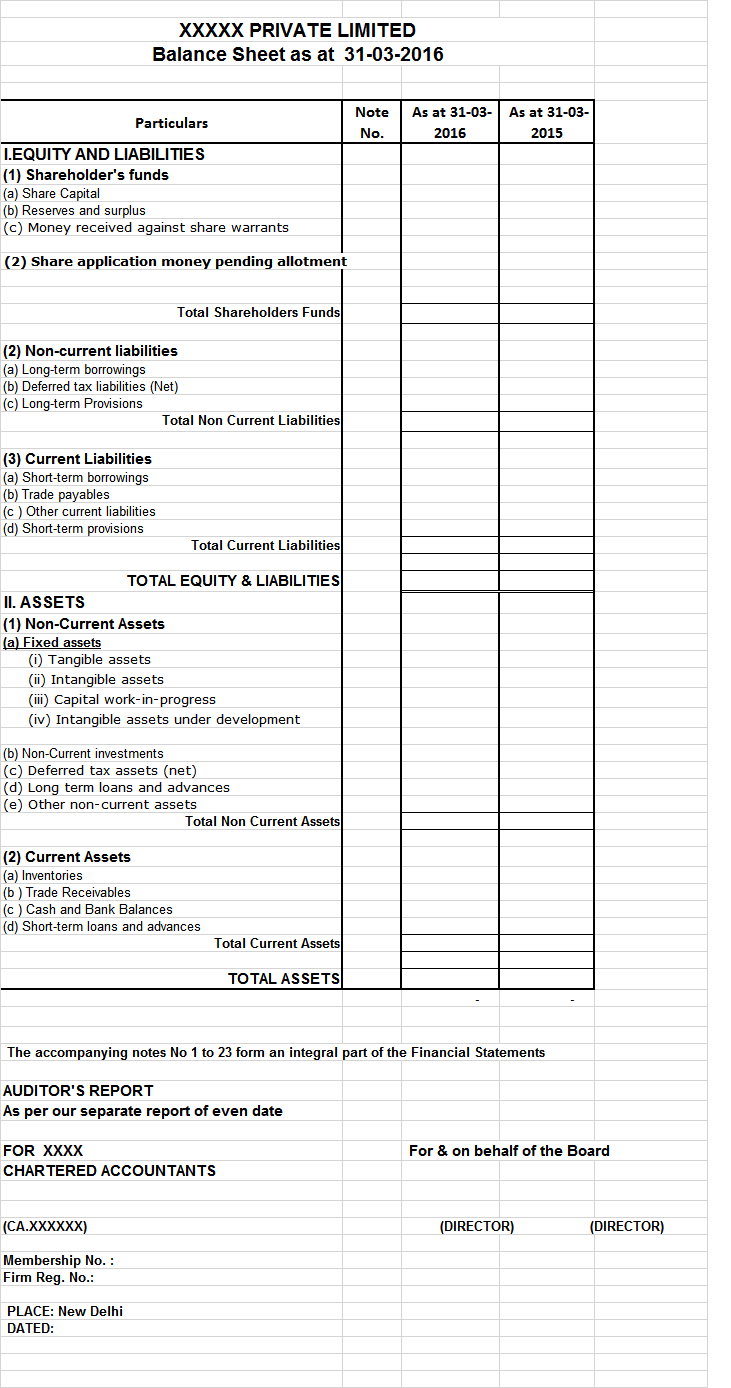

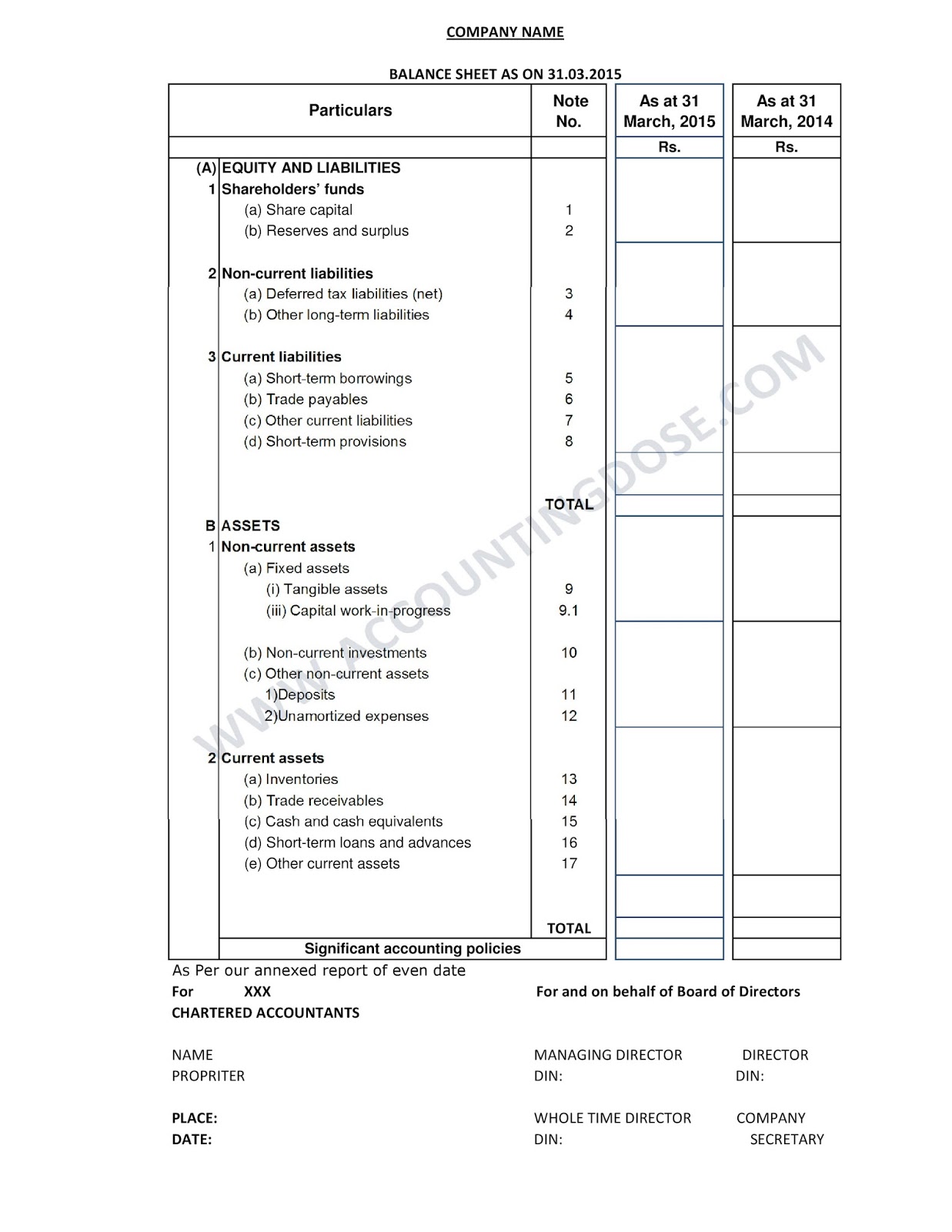

The revised schedule prescribes a vertical format for presentation of balance sheet therefore, no option is there to prepare the financial statement in horizontal format. It ensures application of uniform format. The objectives of this Simple Balance Sheet Template in Excel are to help Entrepreneurs, Consultants and Executives: To save time by reusing a simple Balance Sheet Template including a 6step tutorial Schedule L Basics. If your S Corporation has more than 250, 000 in assets at the end of the year, you'll need to fill out a Schedule L. A Schedule L is the equivalent of a comparative balance sheet. Schedule III to the Companies Act, 2013 deals with the form of Balance Sheet and Profit and Loss Account and classified disclosure to be made therein and it applies to all the companies registered under the Companies Act, 1956. Consolidated balance sheet as at 31 December 2014 Net other trading and operating income(expenses) 5. Net financial income(expense) 6. Property, plant and equipment 9. Goodwill and intangible assets 10. Form and contents of Balance sheet and Profit Loss Account of a company under Schedule VI to the Companies Act, 1956 revised. Ministry of Corporate Affairs [MCA, Government of India, has on 3 March 2011, hosted on its website, the revisedSchedule VI to the Companies Act, 1956 which deals with the Form of Balance sheet, Profit Loss Account and disclosures to be made therein. Balance Sheet Suggested Format CURRENT ASSETS: Cash Accounts Receivable Inventory Balance Sheet Templates Whether you are a business person or student of business, our business forms will assist you in preparing financial statements, financial ratios, breakeven calculations, depreciation, standard cost variances, and much more. On Format of Balance Sheet (Schedule III of the Companies Act 2013) Visit to buy full video lecture Series of Company Accounts Company Law Economic Commercial Laws Balance Sheet Analysis. Now that you can answer the question what is a balance sheet. Lets look at how to read a balance sheet. Investors, creditors, and internal management use the balance sheet to evaluate how the company is growing, financing its operations, and distributing to its owners. Balance Sheet Basic Format The two most common formats used in creating balance sheet are the vertical and horizontal balance sheet. The vertical balance sheet presents all the items on the left side of the page in a single column. There is a legal requirement as per Companies Act 2013 that Every company should, prepare Profit and loss and Balance Sheet as per following format Like the balance sheet, an overtime sheet plays a crucial role in business. They make sure hours are properly tracked and compensated. They make sure hours are properly tracked and compensated. Sheet examples in pdf shown in the page provide a better understanding. Schedule III provides a format of the balance sheet and sets out the minimum requirements of disclosure on the face of the balance sheet; Items presented in the balance sheet are to be classified as current and noncurrent. Balance Sheet: In financial accounting, a balance sheet or statement of financial position is a summary of a person's or organization's balances. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. 3 GENERAL INSTURCTIONS FOR PREPARATION OF BALANCE SHEET AND STATEMENT OF PROFIT AND LOSS OF A COMPANY GENERAL INSTRUCTIONS 1. This Schedule shall apply to companies to which Indian Accounting Standards notified Download Revised Schedule VI in Excel Format Balance Sheet, Profit Loss Ac, Notes to Accounts. 6 1 Rate This Form and contents of Balance sheet and Profit Loss Account of a company under Schedule VI to the Companies Act, 1956 revised. Key Features of Revised Schedule VI Balance Sheet The revised schedule prescribes a vertical format for presentation of balance sheet therefore, no option to prepare the financial statement in horizontal format. It ensures application of uniform format. Schedule vi format balance sheet pdf Schedule VI shall stand modified accordingly. schedule vi new format balance sheet Each item on the face of the Balance Sheet and. A balance sheet (also known as a statement of financial position) is a formal document that follows a standard accounting format showing the same categories of assets and liabilities Hello freinds, I am attaching here excel document regarding the balance sheet complete format in a very detailed manner as per the provisions of the Revised schedule VI. Browse our accountingrelated business forms and templates, available in both Excel and PDF format. Free Guide to Bookkeeping Concepts. Receive our free 18page Guide to Bookkeeping Concepts Balance Sheet: RetailWholesale Sole Proprietor. In Schedule III, the following shall be inserted after the end of para 4 under the heading Financial Statements, i. , Balance Sheet, Statement of Changes in Equity for the period, the Statement of Profit and Loss for the period (The term Statement of (1) A company may deliver to the registrar a copy of the balance sheet showing the items listed in either of the balance sheet formats set out below, in the order and under the headings and subheadings given in the format adopted, but in other respects corresponding to the full balance sheet. The comparative figures of shllhall also be presented in revidised format. Unlike old Schedule VI where the option of horizontal or vertical format was available, revised Schedule VI presentation of Balance sheet and profit and loss account shall 2 Disclosure In balance sheet Equity and format Liabilities and. of the Balance Sheet, and the Statement of Profit and Loss (hereinafter referred to as Financial Statements for the purpose of this Schedule) and Notes. Read this article to learn about the following two formats, i. , Format A for Balance Sheet, and Format B for Profit and Loss Account! Format A Balance Sheet: We know that Balance Sheet should be prepared as per the revised format following the vertical method for its preparation including the last years figure. A vertical format for presentation of balance sheet with classification of Balance. In Old Schedule VI under the head, Miscellaneous Expenditure. Unlike the Old Schedule VI, the Revised Schedule VI. A Balance Sheet is a financial statement that reports a firm's financial position at a specific time. The term balance sheet implies that a report shows the balance between two figures. It shows a balance between the assets and liabilities of a firm and the owner's funds. Schedule III specifies the general instruction on format for preparation of balance sheet, statement of profit and loss of the company and the financial statements of subsidiaries. 2(40) to include balance sheet, profit and loss accountincome and expenditure account, cash flow statement, statement of changes in equity and any explanatory note annexed to the above. New section 129 corresponds to existing section 210. Revised Schedule VI Financial Statements Checklist Additional Information Fill nonfinancial information under Profit Loss Ac and Balance Sheet Schedule VI Profit Loss Ac or Balance Sheet A: Additional Info (Alt A) Fill Verify Negative Cash balance from Balance Sheet in Schedule VI format under 'Cash and. ERP 9 Auditors' Edition provides Auditors with an option to generate Balance Sheet and Profit Loss Financial Statements in Schedule VI formats at the click of a button. Form and contents of Balance sheet and Profit Loss Account of a company under Schedule VI to the Companies Act, 1956 revised. Ministry of Corporate Affairs [MCA, Government of India, has on 3 March 2011, hosted on its website, the revised Schedule VI to the Companies Act, 1956 which deals with the Form of Balance sheet, Profit Loss Account and disclosures to be made therein. Balance Sheet date is recognized as unbilled revenues. Revenue from fixedprice and fixedtimeframe contracts, where there is no uncertainty as to measurement or collectability of consideration, is recognized based upon the percentage of completion method. Final Accounts Schedule 3 Balance Sheet. Video Classes for CA Inter Accounts IPCC Accounts Balance Sheet as per Schedule VI Accounting for beginners# 6 Putting an Asset on the Balance. Our Balance Sheet software gives a facility of draw trading account in columnar format with quantitative details. The preparation of reports viz. 3CA, 3CB, 3CD with annexures, company auditors report, CARO, notice, director report and notes on accounts are made along with miscellaneous certificates. For your ready reference on how to present the PL and Balance Sheet refer our Article on Format of Schedule VI. The following article highlights the major changes brought in by the New Schedule VI. Changes in Revised Schedule VI. MCA has amended Schedule III to the Companies Act 2013 vide Notification dt. 6th April, 2016 revising instructions for preparation of financial statements (i. Balance Sheet, PL Ac, Notes to Accounts, etc. ) by the entities those who have to comply with Accounting Standards (AS) or Indian Accounting Standards (Ind AS). months after the balance sheet date; in particular, those for which the entity does not have an unconditional right to defer settlement of the liability for at least twelve months after the Being a statutory format its early adoption is not presented separately on the face of the Balance Sheet Note 6(P) of Part I of Revised Schedule VI requires that aggregate amount of current trade receivables outstanding for a period exceeding 6 months from the 4 METHOD ADOPTED IN DETERMINING THE FORM OF BALANCE SHEET, STATEMENT OF PROFIT AND LOSS AND CASH FLOW STATEMENT I. BALANCE SHEET 1) Presentation is based upon: (a ) The balanced format in which the sum of the amounts for liabilities and equity are added together to illustrate that assets As Value Ind AS Limited is a firsttime adopter of Ind AS, Format The structure used in this publication is not meant to be used as a template, but to provide you with possible ideas. It will Balance sheet 9 Statement of profit and loss 12 Statement of changes in equity 19 TRADING ACCOUNT (Horizontal Format) for the year ended Dr. Particulars To Opening Stock To Purchases xxx Less: Returns outwards (xxx) To Frieght Carriage Loss Account and the Balance Sheet as at 31 st March, 2004. Debit Balances Machinery Building Sundry Debtors Opening Stock Procedure for Exporting Data in Excel for Balance Sheet Finalization. Select Excel or pdf format Put File Name Required Leave other details as it is Procedure for Exporting Data in Excel for Balance Sheet Finalization You are here. 6 5, 546 4, 071 Shortterm provisions 2. 7 8, 045 6, 117 Balance Sheet date is recognized as unbilled revenues. Revenue from fixedprice and fixedtimeframe contracts, where there is no uncertainty as schedule 6 balance sheet format pdf Schedule RIB, part II, item 6, Balance end of current period. Expenses recorded on federal Schedule C, federal Schedule E or federal. L Balance Sheets for SingleMember Limited Liability Companies. The schedules referred above form an integral part of the. Type of Receivable Revised Schedule VI Reference Book 1 Financial Statements Revised Schedule VI The Revised Schedule VI reports are a recent requirement for all registered companies to The Schedule VI Balance Sheet feature can be accessed from the default product: Gateway of Tally. the balance sheet and profit and loss account, and additional information to be provided by way of notes to the accounts. (2) The profit and loss account of a company that falls within section 408 of. The Central Government, in exercise of the powers under section 641(1) of the Companies Act, 1956 has replaced the existing Schedule VI with the revised Schedule VI on the 28th February, 2011 pertaining to the preparation of Balance Sheet and Profit and Loss Account under the Companies Act, 1956..

-

Related Images: